Mortgage Monopoly in Portsmouth?

In the

comparison between Portsmouth, Ohio, and Westlake, Texas, that I made in my

previous post, I emphasized the differences between the two towns. They

don’t make things in Westlake, and

they never have. They skipped the commercial and industrial stage that

Portsmouth and many cities in the Northeast and the Midwest went through. What

is now Westlake was for most of its history north Texas cattle country, but

fairly recently, after a struggle between residents and developers over the future

of the town, dramatized on NPR’s This American Life (click here). Westlake came to life economically as an

“information-based” community. Well west

of the Rust Belt, Westlake is where they make money, or where, more

accurately, they make money on mortgages.

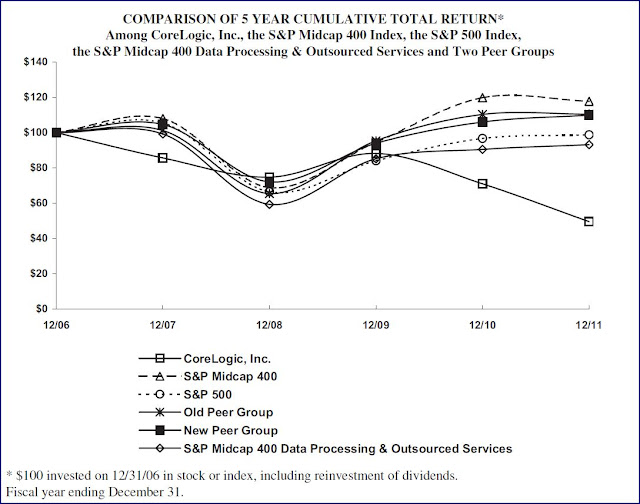

The way Westlake’s

second largest employer, CoreLogic, claims it makes money is supplying

information about the risks involved in selling or buying mortgages and

insurance. But at least where Portsmouth is concerned it appears that CoreLogic’s

main business is not selling information about but rather buying Portsmouth mortgages

from local banks, including, and perhaps particularly, from American Savings

Bank. By rough estimate, in the last ten

years or so about eighty per cent of Portsmouth mortgages were CoreLogic. Though

it is not a Fortune Five Hundred company, it appears CoreLogic is mopping up the floor in Portsmouth with the

likes of Fortune Five Hundred mortgage companies like Bank of America, Wells

Fargo, and Fifth Third, which rank nationally among the top mortgage giants.

CoreLogic looks like it’s well on its way to monopolizing mortgages in

Portsmouth.

City Officials: Portsmouth and Chillicothe

Who holds

CoreLogic mortgages in Portsmouth? City officials, among others. Portsmouth’s

unelected mayor doesn’t have a mortgage

because he bought his house at so low a price that he didn’t need one. But the

city auditor, the second most important city official, has a CoreLogic mortgage

on a $134,000 house. The city solicitor,

the third most important city official,

has a CoreLogic mortgage on a $192,000 house on Willow Way, in the Hill

section of the city. The solicitor paid $192,000, or about $50,000 more than

the $142,820 valuation that the county auditor

placed on it. The $192,000 figure is puny by the standards of Westlake

but is way up there by Portsmouth’s.) The $50,000 is a much larger disparity (35%)

than usual between the county auditor’s valuation and what a home sells for. Incidentally, there are five other houses on Willow Way, a short street, that have CoreLogic mortgages.

Of the three members of city council who have mortgaged homes, two are with

CoreLogic and the third is with American Savings Bank (ASB). Former police Charles “Matt Dillon” Horner’s

home on 28th Street does not have a mortgage, but a dozen other houses on the

street do, and eleven of the twelve are with CoreLogic while the twelfth is

with Bank of America.

In the past

I’ve compared Portsmouth and Chillicothe

because the two cities have a lot in common. Do they have CoreLogic in common? Apparently not, at least

not among city officials. Looking at the real estate records of Chillicothe city

officials, I found a wide variety of mortgages, but CoreLogic was not among

them. The Chillicothe mayor has had a number of mortgages, all with Chillicothe

banks, especially with the Chillicothe branch of National City Bank, whose

corporate name is now PNC. It’s what I would expect a politician to do—support

the local economy by patronizing local businesses, especially for an automobile

or mortgage. All other things being equal,

whether you are a politician or ordinary citizen, why wouldn’t you want to

support the local economy? The Ross County recorder has an extensive real

estate history, which began back in

1973. Her mortgages usually had direct ties to Ross County and Chillicothe. In

the last ten years, she has mortgages almost exclusively from the Chillicothe Fifth Third Bank. So for some

time, with their mortgage choices, Chillicothe public officials have been

supporting Chillicothe’s economy, not Westlake’s.

Portsmouth

has a PNC branch and a Fifth Third branch in Portsmouth. but they are also-rans

compared to CoreLogic. The Portsmouth Fifth Third branch resembles a poor

cousin of the Fifth Third family. Because it can’t afford the spacious downtown

building it now occupies, Fifth Third, under the coaxing of developer Jeff

Albrecht, has tried to persuade the city

government to move its offices to floors

above the bank. But like the Marting building, the First Third building hides

its age behind a deceptive façade. The facade ain’t really brick at Marting’s and neither is

at Fifth Third. The heating and cooling systems in Fifth Third are reportedly a

problem, as is the roof. Though it is not nearly as old as the Marting’s, the

Fifth Third Building is unsuitable for city offices. The taxpayers of

Portsmouth would be taking not much less of a screwing if Albrecht, acting like

a procurer, is able to bring Fifth Third and the city government together.

Questions Remain

Questions remain: why is so much of Portsmouth’s mortgage money ending up about

a thousand miles away in Westlake when branches for Fortune Five Hundred

companies, such as Fifth Third Portsmouth are hungry for business, including mortgages. What

other banks besides American Savings Bank, acting as intermediaries, and

subsequently as agents, are selling mortgages to CoreLogic? Is CoreLogic paying

that much more than its competitors? Shouldn’t CoreLogic’s shaky financial

situation and peculiar relationship with its former partner First American be a

warning sign? If there was some tacit separation agreement between First

American and CoreLogic that the latter’s main business would be selling

information about mortgages and First American’s would continue to be buying and

selling mortgages, or mortgage notes, CoreLogic’s footprint in Portsmouth constitutes

evidence to the contrary. Furthermore, First American acknowledged in its 2011

filing with the Securities Exchange Commission that the fact that it and CoreLogic were now competitors, not

partners, posed serious potential financial risks. There is an executive, Parker Kennedy, who

occupies the same position at both companies! Isn’t that a clear conflict of

interest?

Is there

somebody in the financial circles in Portsmouth involved in a conflict of

interest, at least where mortgages are concerned? Is there some suit in some hypothetical

bank in Portsmouth who, in selling mortgages to CoreLogic, is selling out the

citizens of Portsmouth, and is that hypothetical bank as financially shaky as

CoreLogic? And do those homeowners in Portsmouth with CoreLogic mortgages understand

that they are helping make Westlake the most prosperous community in America

while Portsmouth remains among the poorest? Where’s the logic in that?

The city official who has most to explain is solicitor Mike Jones because his mortgages with CoreLogic, American Savings Bank, and the now defunct and disgraced Southern Ohio Growth Partnership are as illogical as any one person’s could be. Jones has proven as incompetent in the donut business as he has in the courtroom. He appears to be a sucker for overpriced mortgages, and it would not be a surprise to see him declare bankruptcy, following in the footsteps or our former mayor Jim Kalb, our current unelected mayor David Malone, and the next in line to be mayor, city council president John Haas.

Somebody who might be able to unravel the mystery of Jones’s mortgage with the SOGP is Bob Huff, that defunct organization’s director, but he is not talking about Jones, CoreLogic, or anything else. Maybe he is waiting for his day in court. On the day the new Grant Bridge opened, our hip angel of the airwaves, Steve Hayes, reported that Bob Huff, in the manner of Neal Hatcher, was giving passing motorists the finger. Now it may be Huff, left holding the bag, who is getting the finger. Huff’s home on North Hill Road, incidentally, has a CoreLogic mortgage.

|

| Bob Huff, yet another CoreLogic mortgagee, fired for allegedly cooking the books at the SOGP |